A publishing industry that is increasingly focused abroad, less concentrated on new releases and bestsellers and more on catalogue and long tail titles, capable of meeting an evolving demand for reading: this is the picture painted by the Report on the state of publishing in Italy in 2020, presented at the Frankfurt Book Fair.

INTERNATIONALISATION

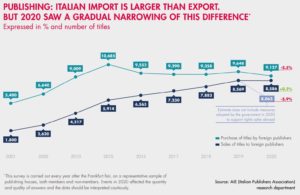

Even during the year of Covid and the hiatus in international fairs, Italian publishing is growing on foreign markets: in 2020, the rights were sold for an equivalent of 8,586 works, up 0.2% on 2019 and equal to 12% of new publications. In 2001, only 4% of the titles published proved interesting to foreign publishing houses. Last year’s good results were influenced by the public support policies, in particular a special funding of 700,000 euros managed by CEPELL, Centro italiano per il Libro e la Lettura (Italian Centre for Books and Reading) for the translation of Italian books abroad, and ICE Italian Trade Agency initiatives supporting publishers on foreign markets in collaboration with AIE (Italian Publishers Association) and targeting SMEs in particular. There was a setback for imports however: 9,127 titles by foreign authors were purchased by Italian publishers, a 6% decrease that must however be set against a more general reduction in titles published during the year. The long period saw confirmation of the trend that leads to equal exports and imports (to date more numerous): over the last 19 years the former have increased at an average annual rate of 19.9%, the latter at 4.3%.

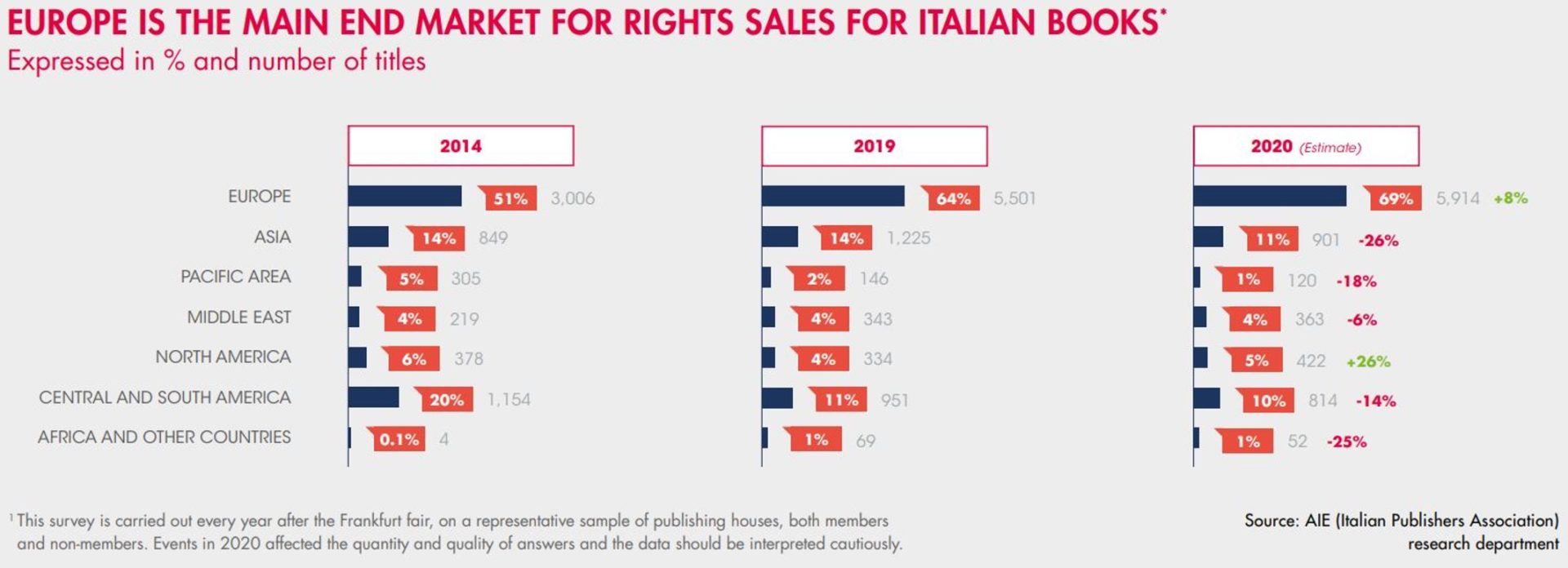

We are still buying more publishing rights from foreign publishers than we manage to sell, but in some sectors like children’s, illustrated and nonfiction books, the situation has already been overturned. In numbers: 2020 saw narrative imports at 3,349 and exports at 2,420. In the children’s and YA sector, 2,812 titles were exported and 2,190 imported, exports of nonfiction stood at 2,027 and imports at 1,460, and, finally, illustrated books saw Italy sell 712 titles abroad and buy 93. With 5,914 works purchased, Europe remains by far the top end market, accounting for 69% of all titles sold abroad. Spain bought 1,301, followed by France with 917, Poland with 650, Germany at 591 and the United Kingdom 237.

In parallel, Italy confirms its role as a country that is very receptive to foreign cultures and books, a country that translates a great amount and that however, as time passes, depends less on foreign books. Between 1997 and 2020, titles by Italian authors grew by 56%, translations by 24%. In 1997, one new books was translated for every 4 published, today this ratio stands at “just” 17%. In 2020, the top language translated was English (62% of all translations), followed by French (16%), German (7%) and Spanish (4%).

Source: AIE (Italian Publishers Association) research department

Source: AIE (Italian Publishers Association) research department

PRODUCTION

Fewer new printed books, more digital books, an increasingly more important catalogue: production of books in Italy in 2020 underwent radical change following lines of development that, on the one hand, were affected by the first year of the pandemic but, on the other, showed an acceleration in trends already evident in previous years.

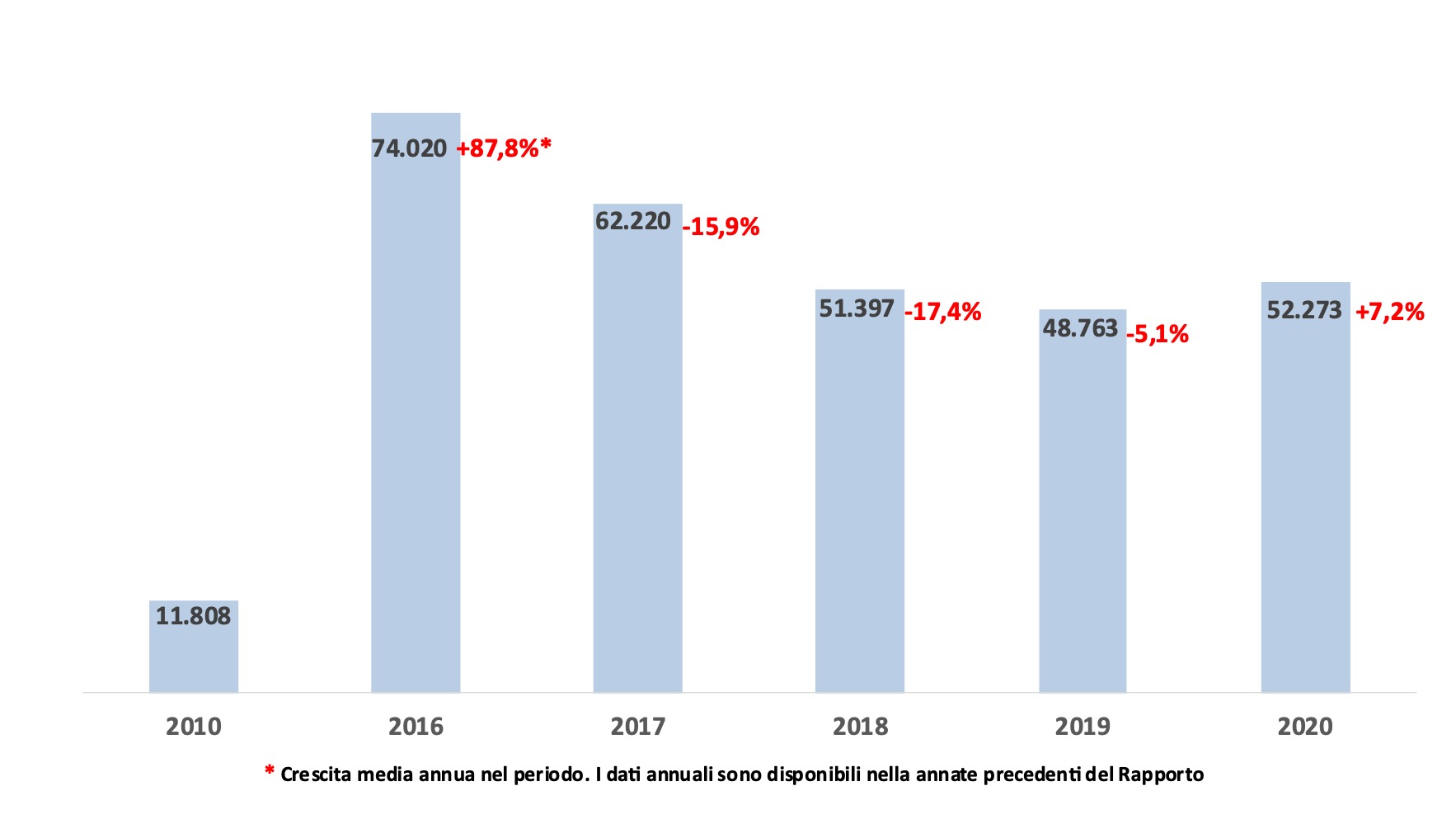

69,608 new titles were published in the trade publishing, a figure down by 5.6%, and 4,067 in the educational publishing, down by 10.3%. At the same time, however, e-books grew by 7.2%, reaching a total of 52,273. These figures show the effect of the brusque stop during the first lockdown (between 9 March and 17 May we had 59% fewer printed books published and 21.4% more e-books), but at the same time they shift towards changing consumer habits that are gaining ground, with digital reading growing in all age groups.

For the second consecutive year, a decrease in supply goes hand in hand with an increase in sales (up by 0.3% for trade printed books in 2020, 2.4% if you also include e-books and audiobooks); in 2019, the production of trade books dropped by 1.3% compared with a 4.8% growth on the market. This leads to a rethinking of the belief that only a sharp increase in production would bring market growth. Another strengthening trend is lower retail price. In 2020 the average price of books calculated at production (not weighted for circulation) was 19.813 euros (down by 0.6% compared to 2019) and a good 1.79 euros less than in 2010.

The growth of online retail, on the other hand, is making the long tail more accessible with the result that, today, in commerce titles amount to 1.26 million, up by 4.5%, and this does not take self-publications into account. This figure stood at 716,000 in 2010. E-books total 500,000, compared to 17.000 in 2010. Over the past two years there have basically been fewer new titles published than in previous years, but supply is still bigger as the number of books no longer available year after year has reduced. New titles represented more than 65% of production throughout the 2010s, with peaks close to 70% in some years. In 2019, the last year for which we have this figure, this value drops to 61.4% in favour of reprints and new editions, namely books already “in the catalogue”. A catalogue that in fact has grown by 45.9% over the past four years (29.8% of new titles).

Going back to the production of printed books and breaking down the figures by genre, the drop has affected the entire trade publishing, but to varying degrees: at -4% fiction has suffered less than the market average of 5.6% and today accounts for no less than 32% of the total (26% in 2010), as has specialist nonfiction (-1.6%), while practical nonfiction (-11.9%), children and young adults (-7.2%) and general non- fiction (-7.2%) are worse hit. These figures do not take into consideration self-publication, a phenomenon which is continuing to expand. In 2020, 10,320 titles by self-published authors were released by specialist companies. They account for 14.8% of overall production and this figure is up by 30.2% compared to 2019. To these must be added the 17,316 self-published e-books of which 60% is estimated to be fiction.

Production of e-books in Italy: 2010-2020*

Expressed in number of titles and %

*Average annual growth for period in question. The annual figures are available in the previous years’ reports. Source: IE-publishing information elaborated by AIE (Italian Publishers Association) Research Department

MARKET

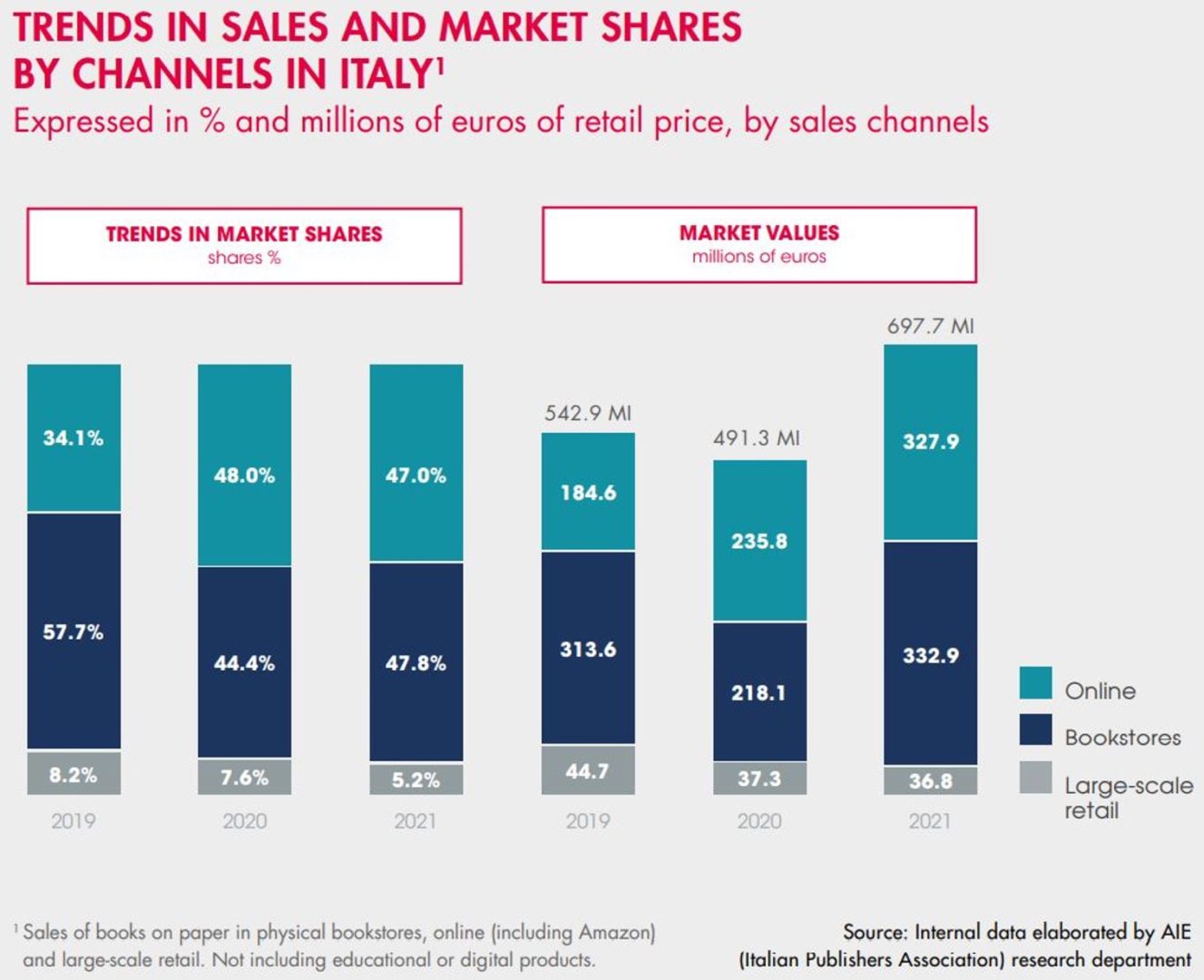

After the trade publishing posted 2.4% growth in value during 2020, (0.3% for printed books alone, therefore excluding e-books and audiobooks), the Italian publishing industry showed a surprising leap of 42% during the first six months of 2021 compared to the previous year (trade publishing) and, especially, of 28% compared to a 2019 that was already considered an excellent year, almost as if 2021 heralded the start of a new trend following the sluggish period that began in 2011. In these six months therefore, the value of copies sold stands at 698 million euros, 156 more than 2019. The average retail price of books sold (14.68 euros in the first half of the year), is down by 1.6% on 2020 and by a good 2% on 2019, which means, a 31% growth in copies sold during the first six months. How can these surprising figures be explained? One contingent factor is the extension to 28 February of the deadline for those turning 18 in 2020, to spend any residual sums of their 18app 500-euro bonus. In a year that saw the suspension of live concerts and performances, much of this was spent on books: in the first two months 75 million more was spent than the year before, 36% of the sales of the first six months. But the behaviour of readers also sees big changes, with numbers that in 2020 were already up on the previous year (61% compared to 58% in 2019). 31% of readers say they read more than before and 25% say they buy more than before, while only 13% say they read or buy less. A demand for reading and books up by a significant amount, therefore, met by a publishing market increasingly more capable of satisfying the so-called long tail, with good availability in online bookstores: the driver behind this growth is therefore the catalogue, not bestsellers or new titles. The 50 bestselling titles in the first six months of 2021 represent less than 8% of the value of the overall amount spent by the public in the purchase of books, and about 7% of copies. This is a trend that publishers are responding to with increasingly more pondered editorial choices, aiming to identify the right mix of new titles, long-sellers and a variety of genres and books that best meet an increasingly more diverse demand.

This article is written in the frame of Aldus Up, the European bookfairs network co-founded in the framework of the Creative Europe programme.

1Sales of books on paper in physical bookstores, online (including Amazon) and large-scale retail. Not including educational or digital products.

Source: Internal data elaborated by AIE (Italian publishers Association) Research Department

This article was originally published on Giornale della Libreria, October 2021.