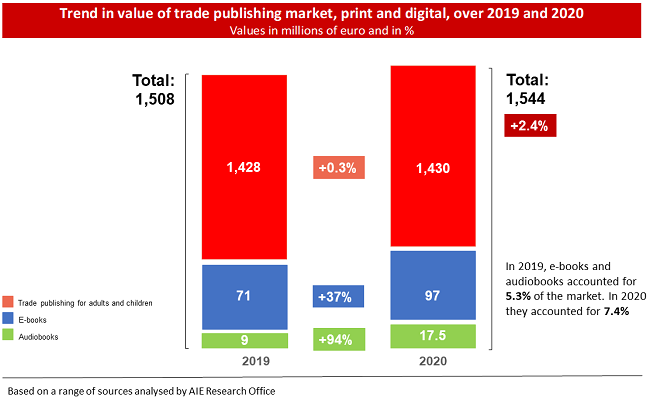

2020 continues to shock – in March no one would have predicted this, or even imagined it. Ending 2020 +0.3% up on cover price value in trade channels, with 1.430 billion euros in trade publishing alone, would have seemed pure fantasy. Even the most optimistic only dared suggest a closing range between -7% and -10%. It is all the more remarkable considering 2019 had been an extraordinary year, with trade publishing up +4.9% on 2018. And there were few signs of what was to come even as the year progressed; in May, we were still down at -20%. Yet that figure gradually fell: -11% in July, -7% in September, until it hit +0.3% in December.

The +0.3% figure only applies to books. When we take “digital trade publishing” into account, it rises to +2.4%; this includes e-books and subscription revenue from audio books (114.5 million overall). In total, the trade publishing market – print and digital – is worth at least 1.54 million: more than its value in 2011.

However, there are two things we need to bear in mind when it comes to the 2020 crisis. First, as opposed to previous recessionary periods (subprime mortgages or the sovereign debt crisis), which originated in finance, the Covid-19 crisis had an immediate impact on the real economy. And it continues to do so, as we are witnessing in the early part of 2021.

This first aspect ultimately led to the +0.3% rise, and reflects several factors: the growth of e-commerce; the new ways in which information is exchanged and we acquire goods; the shift from physical to online sales channels (from 27% in 2019 to 43% in 2020); publishers’ rapidly reorganising their editorial plans and processes; the restructuring of new-release schedules; and “experimentation” with alternative forms of promotion in a year when shows and festivals were drastically downsized.

The second aspect requires us to look more closely at the growth in digital. Printed books rose by +0.3%, but e-books and audiobooks (this is the first time we have estimated them, by calculating consumer spending on subscriptions) registered combined growth of +43.1%.

Trend in value of trade publishing market, print and digital, over 2019 and 2020. Source: Aie Research Office

Compared to previous years, 2020 was very inconsistent – and this was also true of different periods within the year itself. It was a year that forced everyone to rapidly change plans, goals and processes.

To cite another example, physical channels, which accounted for 73% of trade publishing sales in 2019, were down at 52% in April (and in some weeks during March were between 30 and 40%), at 55% in July, and at 57% at the end of September. The figure remained broadly stable in December, with the recovery halted by Italy’s “Autumn lockdown” which affected bookshops in shopping centres at the weekend.

The crisis triggered by the pandemic, which hit the Italian economy suddenly and with great intensity, caused a simultaneous supply shock (the closure of bookshops between March and May) and demand shock. By the 18th week of 2020 we saw a -66% fall in new releases and a +22% increase in e-book editions. In December, there were 9% fewer books published and a +9% increase in e-books.

Digital library borrowing grew in 2020. It became clear that innovative parts of the supply chain had already been offering services that could mitigate the lockdown. In March there was a 140% national increase in Italians using digital borrowing services. Viewings and loans rose from 1.602 million to 4.400 million (+ 176%; Source: MLOL).

Educational publishing is another example: 6.5 million materials were consulted and downloaded from 24 February to 15 June; 220,000 virtual classes activated; and 930,000 teachers took part in free training webinars.

Through the research that AIE has conducted in the past months, we are seeing a comprehensive resetting of reading and purchasing habits. This is no different to what we are witnessing in the food and drink sector. 37% of people who did their food and home shopping in the first four months of 2020 did so for the first time using e-commerce platforms.

Acting like a time machine, the pandemic introduced in just a few weeks changes that would have taken years to materialise, thrusting us into the future (but also back into the past when it came to tourist, art-show and legal publishing).

The same is true of digital. We ended the year with a -9% drop in books but a +9% increase in e-books. In 2019, 14% of books also had an e-book version. In 2020, it was 22%. E-books grew their value by +37%, and audiobooks by +94%. Digital trade publishing had been stuck at 5% for year; in under 12 months it rose to 7.4%.

The world of book retailing – and its customers – was asked to “participate” in this disruption and commit to a new form of modernity. The shift towards digital purchases, including the browsing of nearby bookshops’ websites (or of publishers’ without checking out on the platform) is ground that has been covered, but worth revisiting more consciously in the coming months. Market players are also aware they will have to change their portfolio of products and services for customers, consumers and supply chain partners.

In the past 12 months, publishers, publishing retail businesses, and, more broadly, the whole supply chain have lived through one of the most difficult periods in recent history – a full-scale stress test of their ability to react. The two aspects we have reflected on above both lead to the same conclusion. We have reacted and reacted quickly. The Italian government’s measures gave businesses breathing space in 2020, they helped publishers to continue operating in a climate of greater reassurance. They also helped create demand. It means we can conclude that the sector in Italy has overcome this stress test, doing better than we had imagined just nine months ago, and also compared to other European countries.

This article was originally published in the digital edition of the Giornale della libreria.